Hamilton has the 20th highest land transfer taxes

Published May 12, 2023 at 3:30 pm

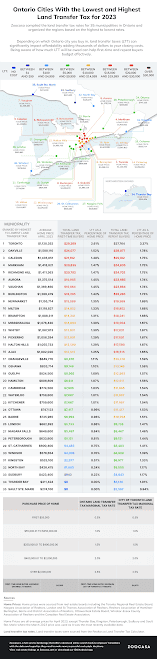

If you’re looking for a city with lower land transfer taxes in Ontario, Hamilton is among those that rank in the bottom half of a list released this week.

The land transfer tax (LTT), based on the total purchase price of the home, is another major expense to consider for homebuyers.

It must be paid upfront as part of closing costs and can increase a homebuyer’s closing costs by thousands of dollars, according to Zoocasa, a full-service brokerage that offers online search tools on Canadian real estate.

Hamilton is No. 20 among 35 Ontario municipalities in a recent ranking released by Zoocasa.

Zoocasa analyzed the nearly three dozen markets across the province to find out where buyers will pay the most and least in LTT.

With an average home price of $806,809, Hamilton has a transfer tax between $5,000 and $9,999. First-time homebuyers in Ontario qualify for rebates of up to $4,000.

Here are the stats for Hamilton:

- The total land transfer tax for the city’s first-time buyers is $8.611

- The land-transfer tax as a percentage of home price is 1.07 per cent

- The total land transfer tax for repeat buyers is $12,611

- The LTT as a percentage of home price is 1.56 per cent

It’s even better for first-time buyers in Sault Ste. Marie and Thunder Bay, who may not have to pay any LTT due to Ontario’s first-time buyer rebates of up to $4,000, according to Zoocasa. That’s because the LTT for a home at average prices is less than the rebate.

Sudbury has the lowest LTT. For instance, a home at the average price of $423,400 would pay $963 in LTT, according to Zoocasa.

Meanwhile, homebuyers in hotter real estate markets like Toronto, which ranked No. 1 on the list, can be on the hook for the highest land transfer taxes. Toronto homebuyers could pay between $29,289 and $37,764 in LTT.

Oakville, Caledon, Markham and Richmond Hill had the highest LTT after Toronto.

If the home price is lower than the national average of $686,371, buyers can expect to pay a maximum of $6,000, Zoocasa reported. Those buying a home for less than $1 million will likely pay less than $10,000 in LTT.

Repeat buyers are not eligible for a rebate. In Hamilton, the total land transfer tax for repeat buyers is $12,611. Repeat buyers in London, Niagara Falls and St. Catharines will pay less than $10,000 in LTT.

Home prices were sourced from real estate boards including the Realtors Association of Hamilton-Burlington. Land transfer tax rates were sourced from Realtor.ca Land Transfer Tax Calculator.

insauga's Editorial Standards and Policies advertising