Early Budget Talks Suggest a Tax Increase Could Hit Mississauga Residents

Published June 28, 2018 at 4:31 am

A tax increase could be coming for Mississauga residents.

It’s mid-way through the year and discussions surrounding the 2019 budget and taxes for Mississauga are already underway. Earlier this month at the budget committee meeting, councillors discussed the opportunities, challenges and changes that are forecasted for the 2019 year.

It is expected that overall the budget for the city will increase by $30.7 million and taxes will increase by 2.1 per cent for residential and 1.3 per cent for the commercial bill for 2019.

At the meeting, it was mentioned that managing the budgets and taxes is something that takes up most of the year. Part of the challenge is finding a balance between providing services that the public wants and needs and keeping taxes low.

In the most recent Citizen Satisfaction Survey, 70 per cent of Mississaugans said they were satisfied with the service they were receiving from the city and 63 per cent felt they received good value for their tax dollars.

“The budget process allows us to develop a strong financial plan that makes investments in our city’s future, while delivering high-quality services such as transit, road maintenance, library service, and so much more that Mississauga residents have come to expect and rely upon,” said Mayor Bonnie Crombie.

“Residents overwhelmingly tell us they believe they receive good value for their tax dollars, which is why we consistently strive for excellence and to find ways to save money. As always, in the coming months we will continue to engage with residents, businesses and community partners to develop a strong financial blueprint for Mississauga for 2019 and beyond.”

The budget that was discussed was an estimated amount based off of the amounts needed to maintain current projects, as well as new developments and plans. These numbers can also change with the new provincial government or with decisions made at upcoming budget committee meetings.

A more detailed budget proposal will be shown later in the year.

The preliminary budget that was proposed estimates an increase of 4.1 per cent for inflation and new services plus a two per cent infrastructure levy.

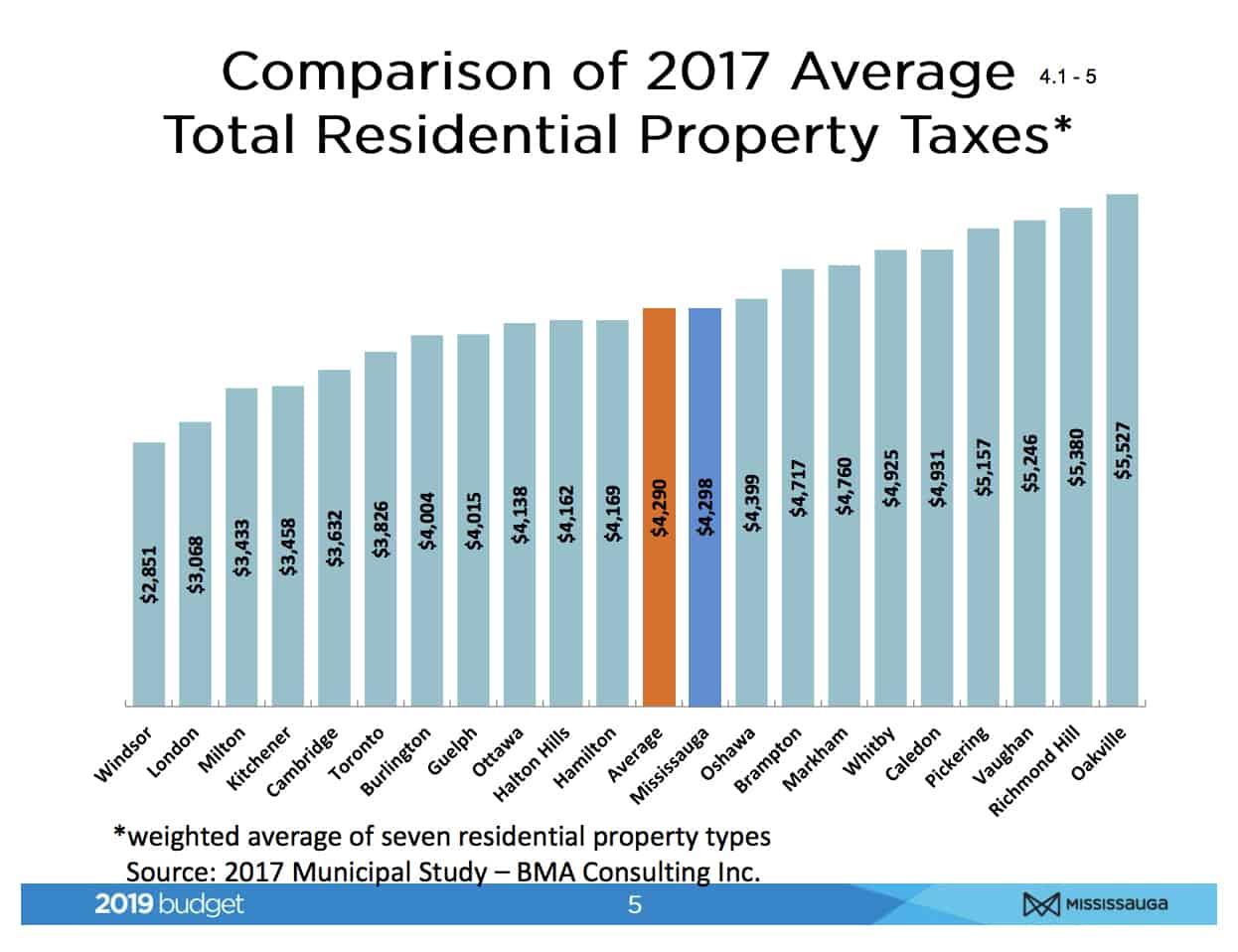

The presentation initially looked at where Mississauga currently stands in terms of property taxes. A comparison of 2017 average total residential property taxes, based on a weighted average of seven residential property types, was conducted by BMA Consulting Inc. The comparison showcases that Mississauga was in the average range of taxes for residential property taxes.

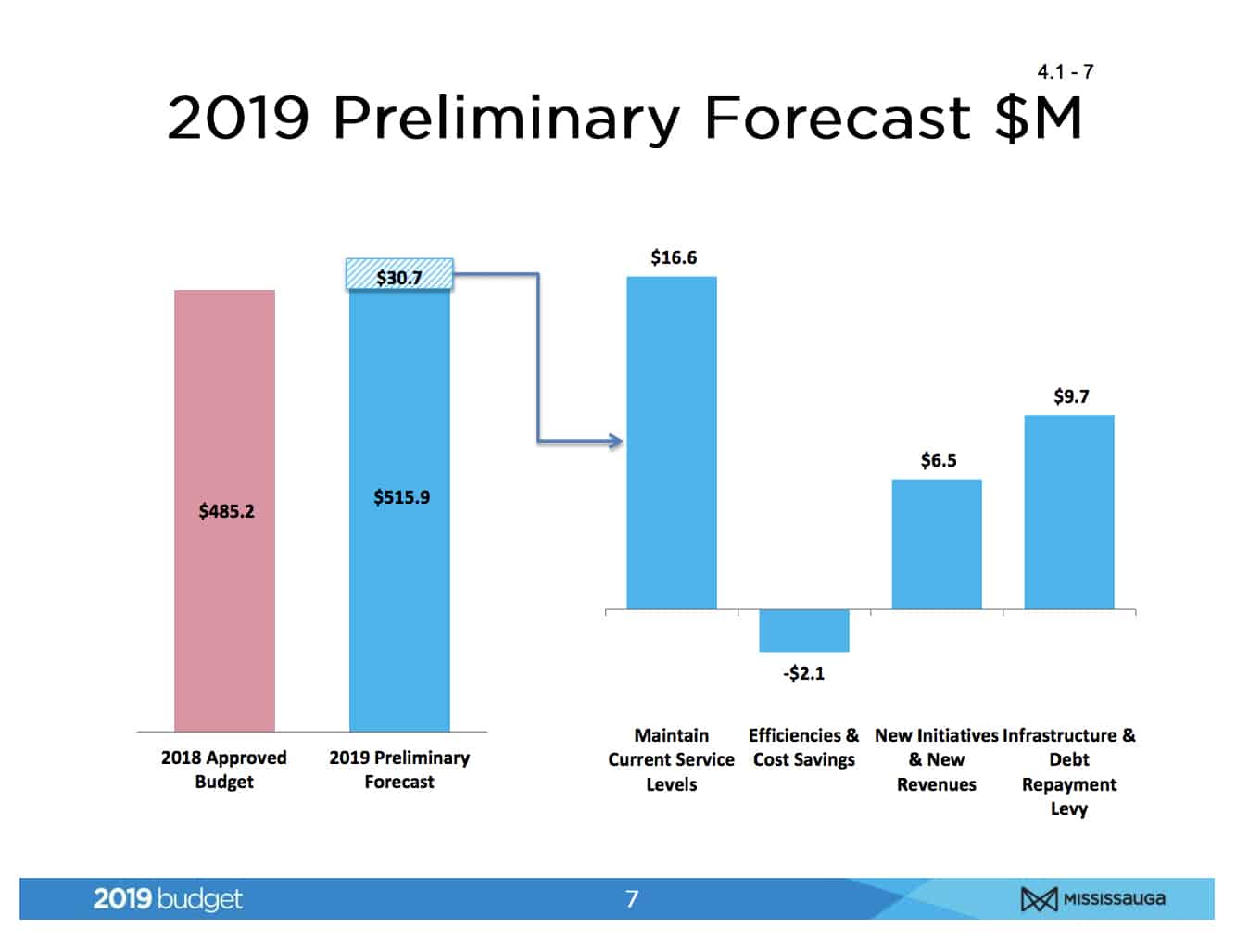

It is expected that the budget will increase by 30.7 million compared to 2018, this is highlighted in light blue in the chart below. This comes from an additional 16.6 million to cover the costs of maintaining current service levels, 6.5 million in new initiatives and revenue. These additional costs are reduced by (2.1) million in savings from efficiencies and cost savings.

It is expected that the budget will increase by 30.7 million compared to 2018, this is highlighted in light blue in the chart below. This comes from an additional 16.6 million to cover the costs of maintaining current service levels, 6.5 million in new initiatives and revenue. These additional costs are reduced by (2.1) million in savings from efficiencies and cost savings.

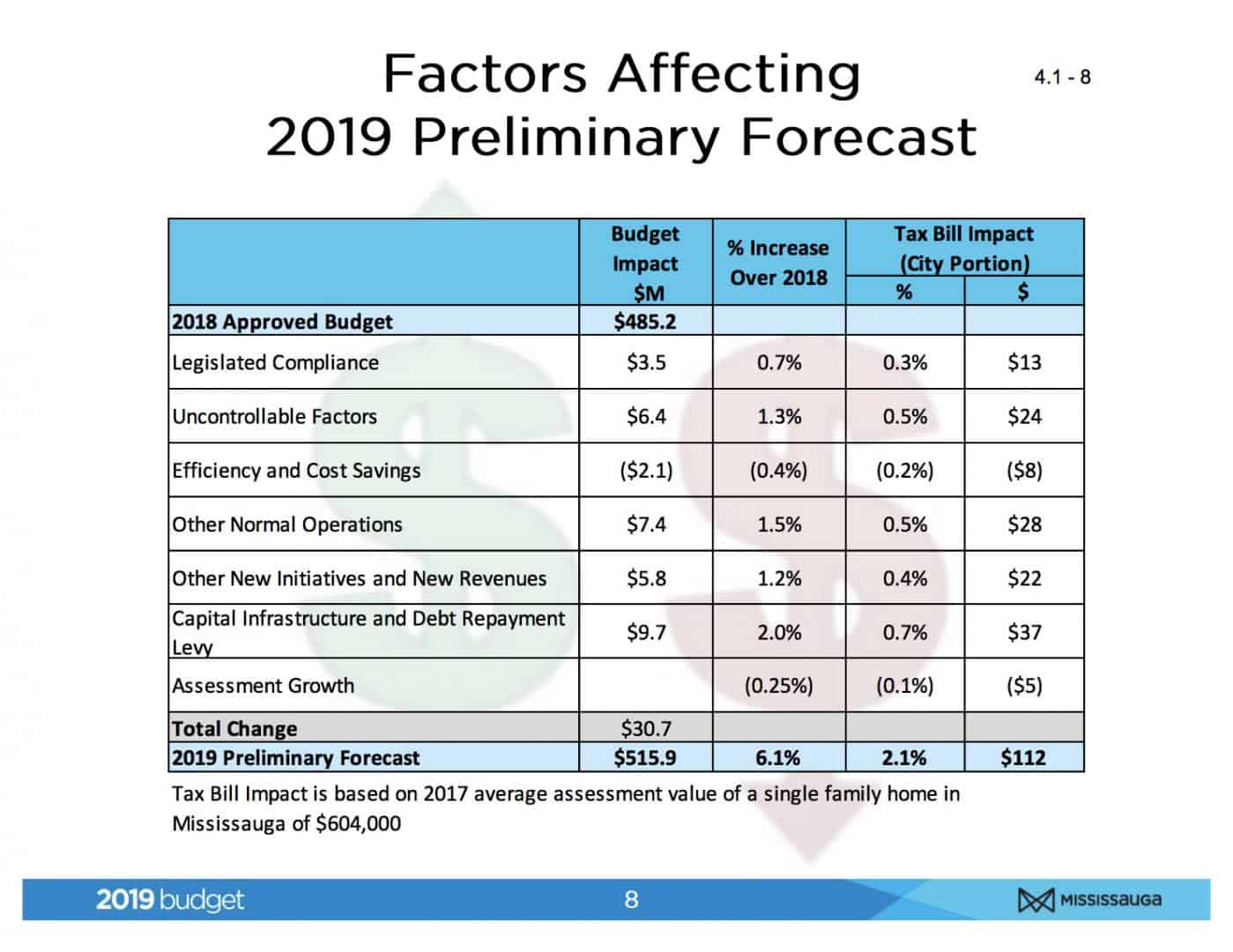

The total increase in budget of $30.7 million by the city translates to a 6.1% increase in taxes from 2018. Some of the increases had to do with Legislative compliances, uncontrollable factors, new initiatives and debt repayment.

The total increase in budget of $30.7 million by the city translates to a 6.1% increase in taxes from 2018. Some of the increases had to do with Legislative compliances, uncontrollable factors, new initiatives and debt repayment.

When looking at the effect of this increase on the average assessment of a single family home in Mississauga valued at $604,000 in 2017, the tax bill impact would be a 2.1 per cent increase or a $112. The tax increase would be 1.3 per cent for commercial properties.

When looking at the effect of this increase on the average assessment of a single family home in Mississauga valued at $604,000 in 2017, the tax bill impact would be a 2.1 per cent increase or a $112. The tax increase would be 1.3 per cent for commercial properties.

“More than ever, we are challenged by the increased costs to deliver our services. In particular, we are facing higher fuel costs, new legislation and unexpected costs downloaded to us by the Government of Ontario,” said Janice Baker, city manager and Chief Administrative Officer.

“The costs to maintain and build our city cannot be covered by the property tax alone. The proposed infrastructure levy enables us to maintain a state of good repair and build for the future. We know there is work to be done, and over the coming months we will work to identify opportunities to reduce the pressure on the operating budget before presenting it to the budget committee in December.”

Budget committee meetings resume on December 5 (budget overview and fees and charges) and continue on January 14, 15, 21, 22 and 28. The 2019 – 2022 Business Plan and 2019 Budget are expected to be approved by council on February 6, 2019.

insauga's Editorial Standards and Policies advertising