Bidding wars return with a ‘vengeance’ in some real estate markets in Canada

Published April 2, 2024 at 10:47 am

A new report suggests the real estate market is ramping up in Canada.

RE/MAX Canada just released its 2024 Spotlight on Luxury Report, which shows a strong start to the year in the higher-end real estate market.

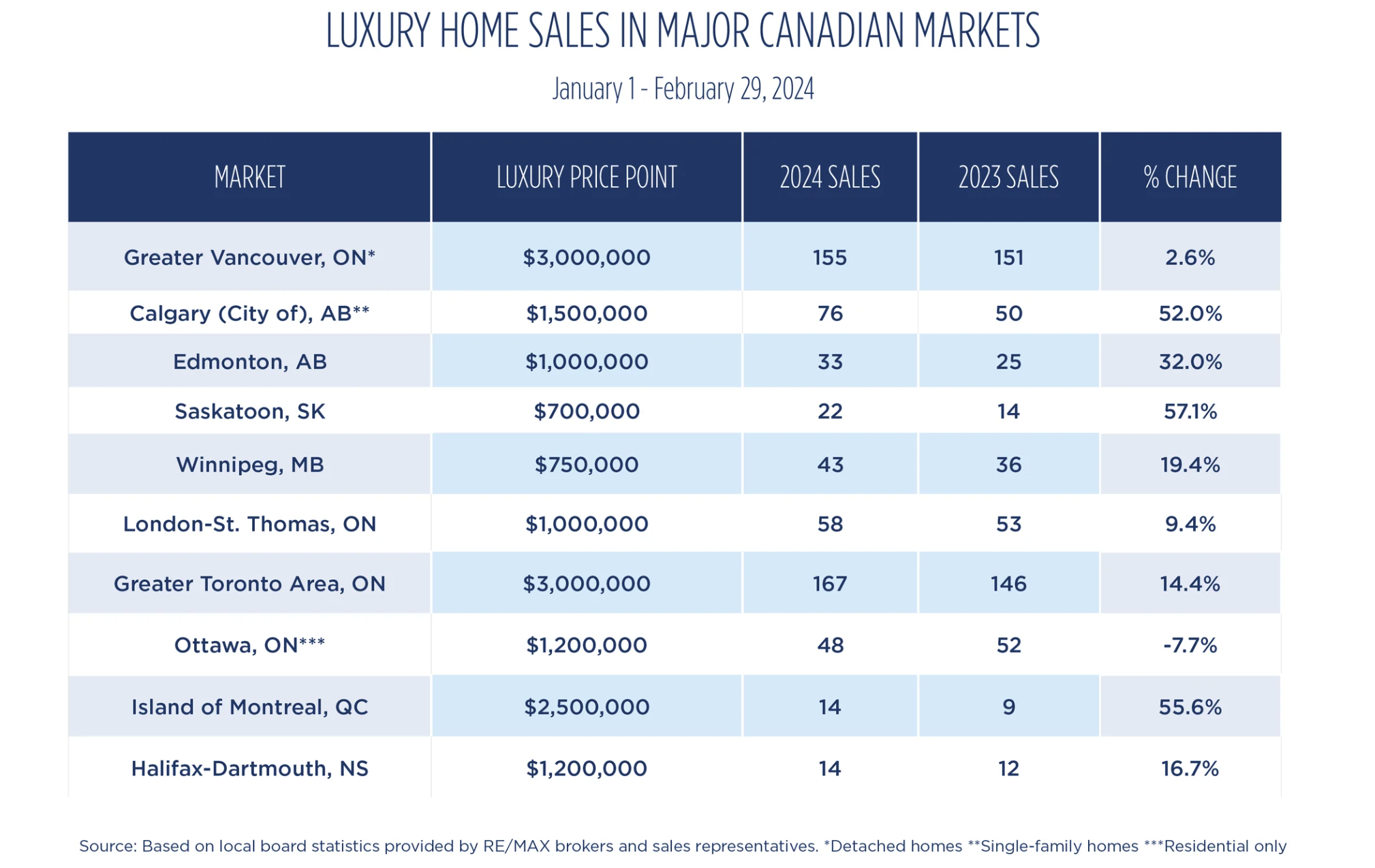

The report focuses on luxury home-buying activity in 10 cities across the country in the first two months of 2024 compared to the same period in 2023.

Ninety per cent of markets experienced an increase in high-end sales, with more than two-thirds recording double-digit growth, according to the report.

The increase in sale activity in the luxury home market is having a “ripple effect” in sales overall, Re/Max Canada president Christopher Alexander said in a press release.

“In some cities where inventory levels are particularly challenging at the lower end, multiple offers have returned with a vengeance,” said Alexander. “While that isn’t the case at the top end, pent-up demand does exist, and activity is gaining momentum.”

Homes in Calgary are getting multiple offers — some homes are selling sight unseen, according to the report. Multiple offers are also occurring in Saskatoon, although at the lower price points.

And Saskatoon led the country, in terms of percentage increases, with a 57-per-cent uptick in luxury home sales, followed by Montreal at almost 56 per cent and Calgary at 52 per cent.

Edmonton posted a 32-per-cent increase in luxury sales year-over-year, while Winnipeg, Halifax, Toronto and London reported increases of 19.4 per cent, 16.7 per cent, 14.4 per cent, and 9.4 per cent respectively.

Only Ottawa saw a decline compared to year-ago levels, with sales down nearly eight per cent.

Overall, the Greater Toronto Area’s luxury market “sprung back to life” in the first two months of the year, according to the report.

The uber-luxe market has heated up significantly in the Toronto area, with a 77-per-cent jump in sales for homes over $5 million. Of the 32 properties sold over $5 million to date, 17 sales occurred in the 416 area code area, while 15 were located in the 905.

There has only been one sale in the over $7.5 million market to date, compared to three during the first two months of 2023.

Demand is particularly strong between $3 million and $4 million for detached homes, but activity in this range is largely hampered by fewer listings available for sale.

Just 115 properties were available for sale between $3 million and $4 million in the central core of Toronto heading into the traditionally busy spring market.

Some communities were down to single-digit inventory levels, including Leaside (three); Cedarvale, Humewood, Forest Hill South, and Yonge- Eglinton (five); Banbury-Don Mills (seven); the Beaches (four); and Stonegate-Queensway (five).

Some downsizing is also occurring in the market, with empty nesters and retirees making more lateral moves into luxury condominium apartments, townhomes, and new builds on smaller-sized lots in desirable neighbourhoods, according to the report.

Eleven condominiums have sold for more than $3 million in the first two months of the year, compared to 10 between January and February of 2023.

Interest rates remain the greatest roadblock to homeownership at present, with many waiting on the sidelines for rate cuts. It’s anticipated that once rates start to fall, Toronto’s housing market will be exceptionally robust, with pent-up demand the driving force behind heated home-buying activity, the report states.

The report also finds that luxury home-buying activity is moving to a younger demographic. The desire for more space and less congestion is once again an emerging trend, as acreage properties boasting large homes in suburban-rural or rural areas experience an upswing in popularity in London, Ottawa, Edmonton and Saskatoon.

Some luxury buyers in the Greater Toronto Area are moving to London, Ontario, Halifax, Calgary, Edmonton and Saskatoon.

And activity among foreign buyers has “fallen dramatically” since the introduction of the Canadian government’s foreign buyer ban in January 2023, which is extended through to early 2027.

For the full report, see the Re/Max website here.