Apartments steady while single-family homes drive the rental boom from Oshawa to Oakville

Published June 15, 2022 at 1:16 pm

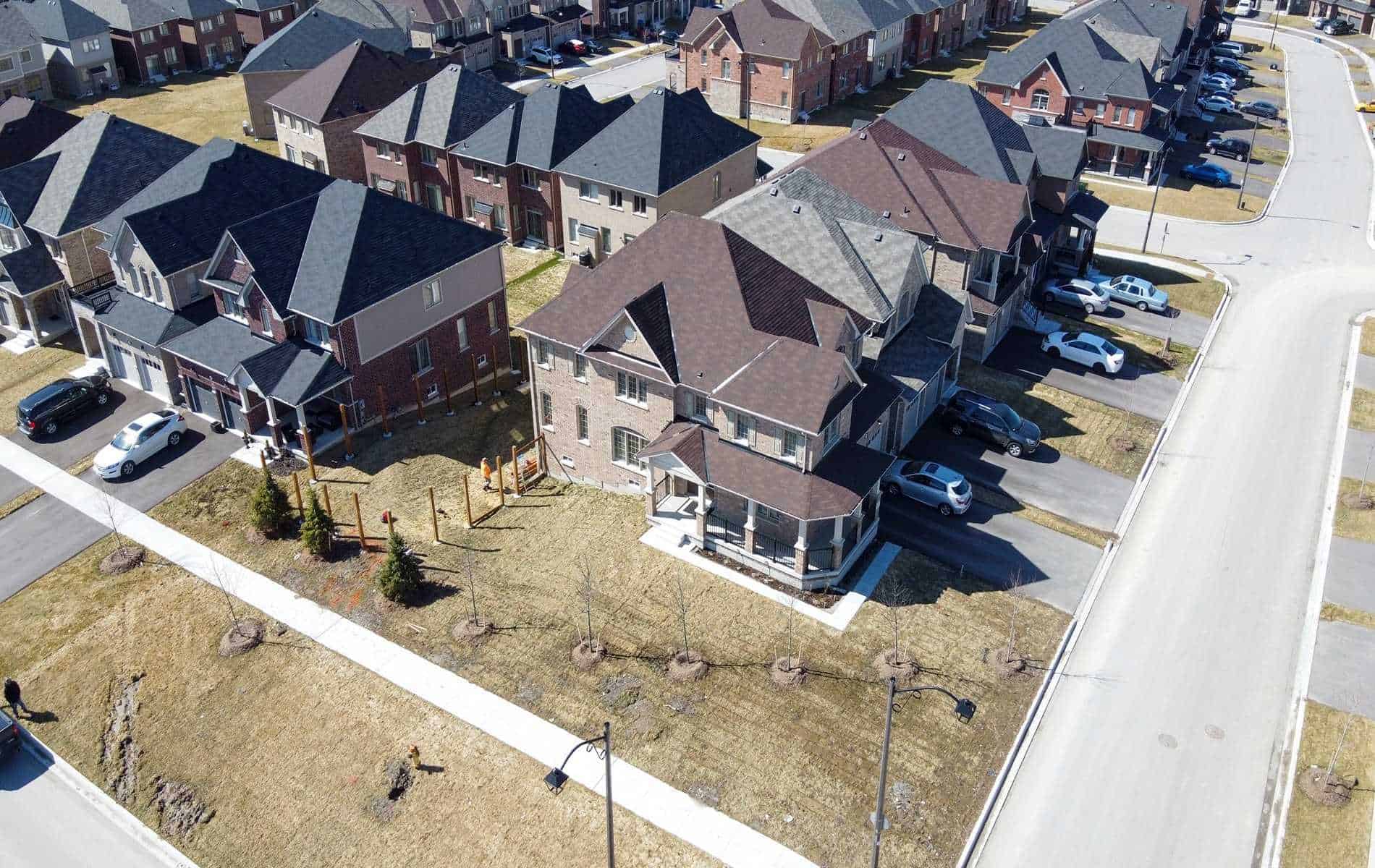

Single-family homes are driving the rental boom across Canada that has seen rents jump more than ten per cent from last year.

The average rent for all Canadian properties listed on Rentals.ca was $1,888 per month in May 2022, which represents a year-over-year increase of 10.5 per cent. This also represents a month-over-month increase of 3.7 per cent, the largest monthly increase since May of 2019. The data includes single-detached, semi-detached, townhouse, condominium apartments and rental apartments.

As per usual Vancouver and Toronto dominated the top spots, with Vancouver averaging $2,377 per month for one-bedrooms and $3,495 for two-bedroom units – year-over-year increases of 19.9 per cent and 24.1 per cent, respectively – with Toronto averaging $2,133 and $3,002 for the same units, an increase from last year of 15.7 per cent (one-bedroom) and 21.5 (two-bedrooms).

Vancouver suburb Burnaby was third and the GTA communities of Oakville (4), Burlington (5) and Mississauga (10) also made the top ten.

Oshawa was ranked 18th, with an average rent for one-bedrooms of $1,663 and $1,903 for two bedrooms. That’s up 8.1 per cent and 17.5 per cent, respectively, from this time last year.

The most expensive units are single-family homes, with landlords asking $2,881 per month on average in May 2022, compared to $2,311 per month for condominium apartments, and $1,696 per month for rental apartments.

Rental apartments typically account for about 55 per cent of listings, while condo apartments for lease make up about 25 per cent, suggesting that rental apartments best represent the overall conditions in the domestic rental market.

Those single-family homes dropped to a low of $2,218 early in the pandemic before jumping back up.

Rental apartments, on the other hand, have not experienced the same level of price growth when compared to single-family homes and condo apartments. Rental apartments have seen their average rental rates increase by six per cent annually.

Uncertainty in the ownership housing market, and the delay in delivering new supply due to supply-chain delays and labour stoppages should continue to put upward pressure on rents into the fall of this year in the face of increased demand.

insauga's Editorial Standards and Policies advertising