644 fraud charges in 2023 and the scams they got caught for in Mississauga and Brampton

Published April 8, 2023 at 3:18 pm

Fraud is like the gift that keeps on stealing, with over 600 incidents hitting Mississauga and Brampton in the last three months.

Residents in the Peel region have seen an average of 5 or more fraud-related incidents per day in the last 98 days.

From Jan. 1 to Apr. 8, Peel police data indicates that there were a combined 644 fraud cases reported across both cities — 337 in Mississauga and 307 in Brampton.

Here is a breakdown of the types of fraud and the number of incidents that occurred:

- Debit and Credit — 111

- Identity theft — 68

- Cyber crime (internet) — 77

- Prescription — 7

- ATM Card — 82

- Cheque — 30

- Counterfeit Card — 4

- Security and Financial — 6

- Other fraud – 259

As of today (Apr. 8), 77 of these incidents are considered solved, while 47 are unsolved and 520 are still being investigated.

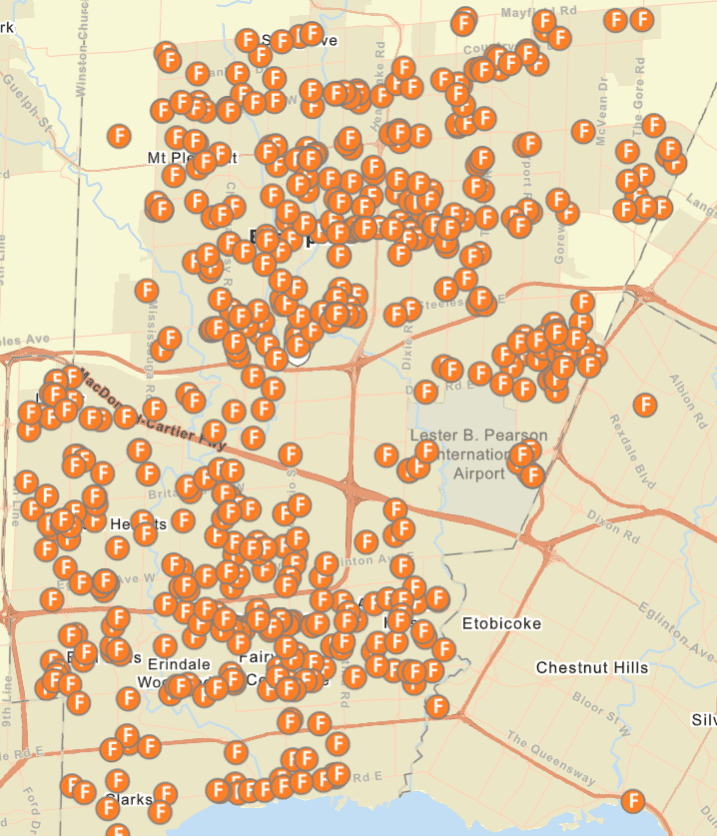

The following map shows where the fraud activities took place:

According to Peel police data, there are several hot spots where the fraud seems to reoccur. The top 5 areas are:

- Quarry Edge Dr

- Peel Centre Dr

- Queen St

- Hurontario St

- City Centre Dr

It appears that there is also a frequent hour for these types of crimes to occur, which is around midnight. The results from the PRP data indicates that 175 out of the 664 frauds committed happen at this time —which is approximately is 27% of cases.

However, the same time last year (2022) the fraud count was sitting at a low number 0f 11 incidents.

Comparing this data to the last 30 days (Mar. 8 – Apr. 8) 2023, there was a total of 96 fraud cases which works out to at least 3 incidents per day.

With the uprising of fraud in Mississauga and Brampton, it could mean that scammers are getting more clever with their schemes.

If you’re using social media apps with advertising pages such as Facebook Marketplace, you might want to be weary of shopping for a rental property.

This scam became more prevalent in the GTA as rental properties became scarce and increasingly unaffordable. People desperate to find a place to live may fall prey to this scam where a fraudster tries to gain access to personal and financial information. In some instances also pretend to give a virtual tour and after asking for payment they disappear.

Another recent but sophisticated scam known as “domain squatting” is making its rounds. The fraudsters place realistic ads for banks that come at the top of Google search results.

For example it would show the you the banking website making it appear legit. But really what they’re doing is that inside that link, there’s a bunch of redirects. And it’s leading you to a phishing website that does look similar to possibly your online banking or an organization where you would normally input your information.”

Although, some fraudsters switch it up by going offline and visiting a bank in person to run their scheme. However, it may not go as planned— as was the case in of the most notable scam stories from last month.

Michelle Furtner of Mississauga walked into a bank in Dunnville, where she attempted to withdraw money, but bank employees recognized the woman from an internal memo and contacted police.

The 34-year-old was charged with fraud over $5,000, and four counts of forged documents.

Peel Regional Police have released tips on how to protect yourself before and after becoming a victim of fraud.

- When using debit or credit cards, cover the machine while entering your pin.

- Be cautious when buying/selling items online. Some ads can be masking as scams.

- Avoid giving out your personal information over the phone.

- If unauthorized transactions have been made to your account, call your bank immediately and sort out if the loss will be covered.

- If the bank determines that they are responsible for the loss, you must get a letter in writing from them and then report it to police.

- Check your bank statements regularly to make sure all transactions were authorized.