4 scams that hit Ontario in April 2024

Published April 20, 2024 at 1:03 pm

Scams persist year-round with new, more sophisticated versions appearing every few weeks.

However, the ultimate aim for most fraudsters remains unchanged: targeting vulnerable individuals to steal money or personal information. Here are four scams that hit Ontario in April.

Package “temporary hold” scam

People awaiting package deliveries who receive text notifications of delays may be tempted to speed up the process by following message prompts, unaware they could be walking into a scam.

In this scam, fraudsters imitate the postal service DHL and advise the recipient that their package has arrived but has been placed on hold. The recipient is then asked to follow the link for further details.

According to the Canadian Anti-Fraud Centre (CAFC), this is an example of “smishing,” a variation of phishing schemes.

Fraudsters will pretend to be businesses, government agencies, banks, or utility companies and urgently request individuals to verify personal information such as name, address, birth date, banking account details, and Social Insurance Number (SIN). If provided, this information can be exploited for identity fraud.

DHL’s Canadian website says, “We send text messages using our shortcode 22345, so you can easily identify when the sender is DHL Express.”

When in doubt, customers are advised to delete suspicious-looking messages without opening them and report them to [email protected]

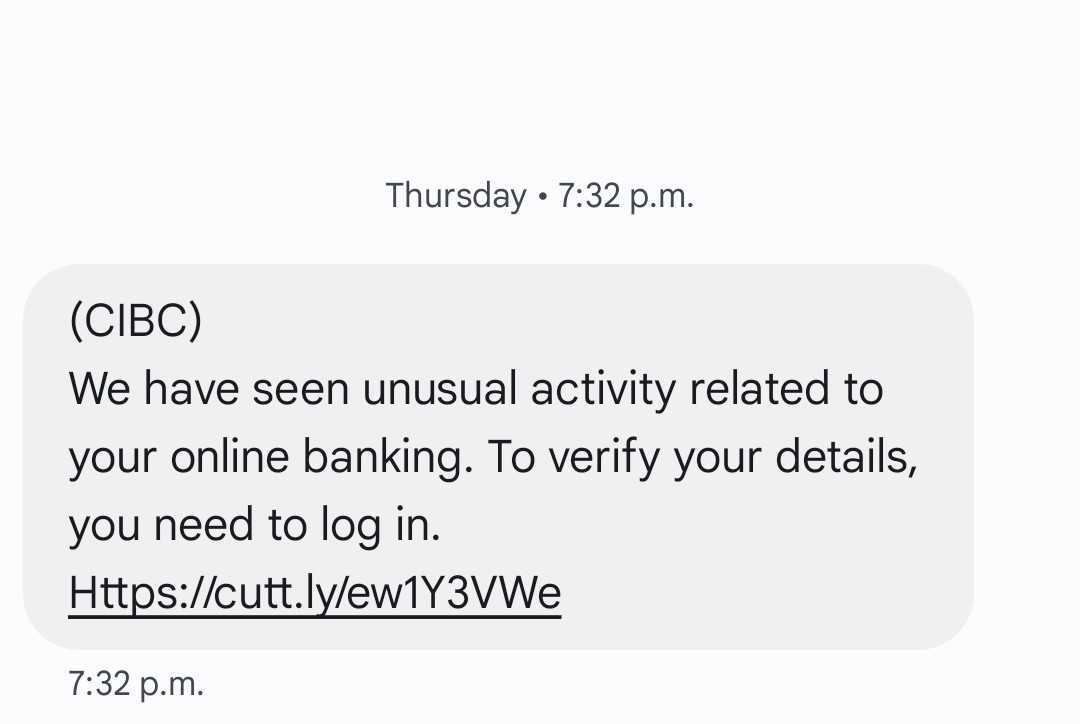

Bank “suspicious activity” scam

Bank scams— a common tactic used by fraudsters— often make people panic by suggesting their financial institution has been compromised, potentially resulting in the theft of information or funds.

In this case, the scammer pretends to be the financial institution CIBC and informs the recipient of some “unusual activity” related to their online banking. The recipient is then given a link that redirects them to a page to verify their account details.

CIBC reminds its clients that it will never send unsolicited texts or emails asking for banking information, personal information or passwords.

A list of fraudulent emails and text messages sent to CIBC clients is on the bank’s website.

Job hiring scam

If you’re unemployed or considering a job change, receiving a text message from a recruiting firm offering a remote position might pique your interest. However, replying to the message may result in more loss than gain.

In this scheme, the fraudster poses as a recruiter for Flex Jobs. A quick Google search may lead you to the company website, giving the impression that the recruiter is indeed contacting you. However, you might want to do additional verification.

A good idea would be to check the phone number from which the text was sent compared to the one listed on the official website. Discrepancies between the two could mean you are being duped.

‘Work from phone’ scam

In a more sophisticated phishing ploy, fraudsters send text messages to victims offering a work-from-phone opportunity with enticing job benefits.

The offer states an average daily pay of $100 to $200, with the work taking so little time that employees could have 50 to 80 minutes of free time.

An added incentive promises the first 100 hires a chance to win $10. Applicants are also encouraged to reply with the number 1 and follow a WhatsApp link for further information.

The CAFC says fraudsters will exploit real businesses, luring victims with freelance job opportunities to promote products, apps, or videos using software they’ve developed.

Once a victim installs the software and creates an account, they’re assigned “orders” or “tasks” to complete. To deceive victims further, they may receive a modest payment or commission, making it seem like the job is “real.”

The CAFC says since Aug. 25 (2023), the company has seen an increase in these job opportunity scams.

Residents are advised never to share personal information with unverified people or groups. This includes information such as their name, address, birthdate, social insurance number, and credit card or banking information.

For extra precautions, individuals should block the number and avoid responding.

The CAFC also offers more helpful tips to avoid falling victim to such scams:

- Don’t click on links from unsolicited messages

- Don’t download attachments from unsolicited messages

- Watch for spelling mistakes

- Don’t trust a message just because the email address looks legitimate; fraudsters can spoof the address

- Beware of messages claiming to be from the Government of Canada or a law enforcement agency; they will never contact you to offer funds via email or e-transfer

For more information and to report a suspected scam, see the Canadian Anti-Fraud Centre website here.